Trusted Irish Tax Return Service

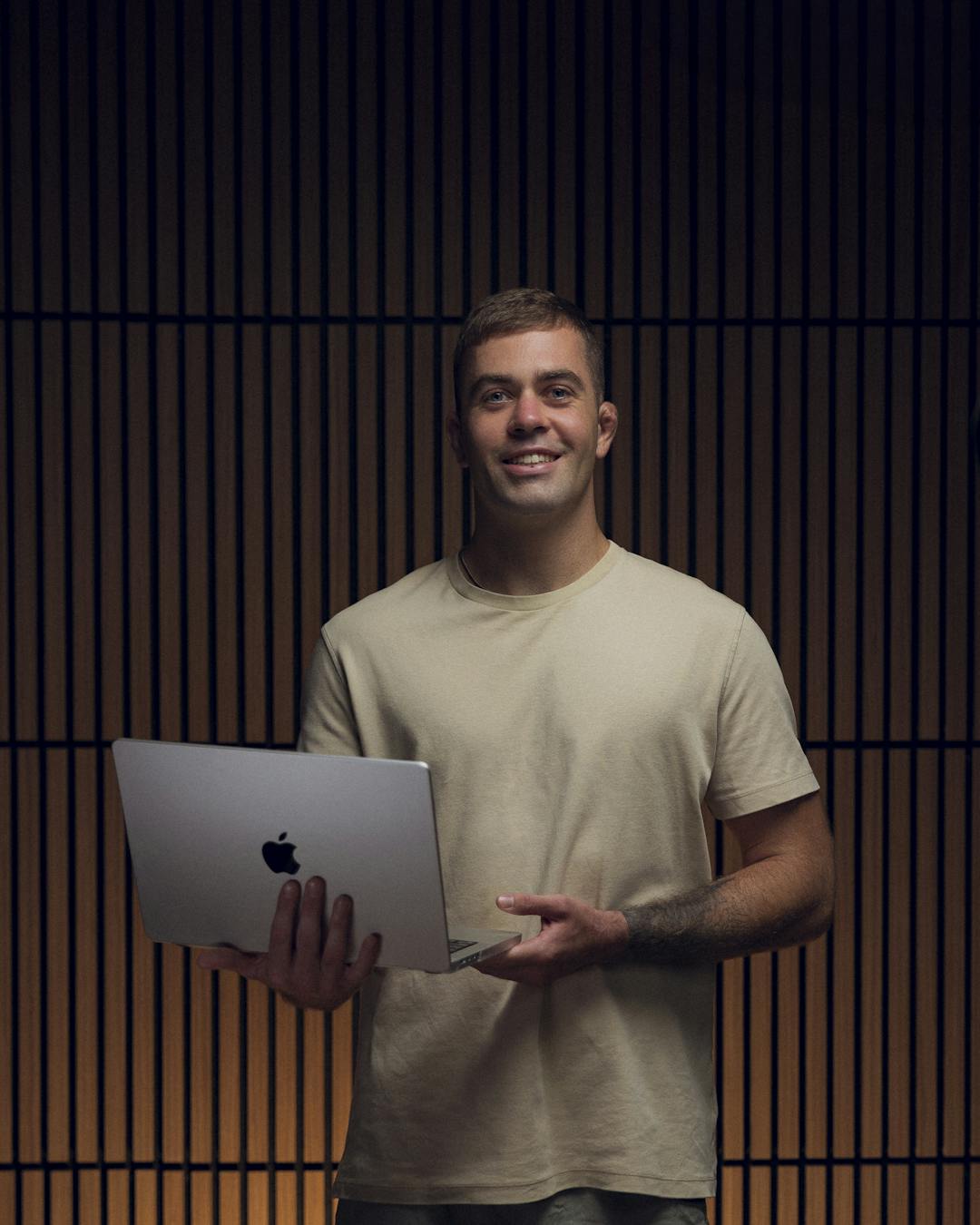

Irish tax returns at fair prices, with one-to-one service from Damien and the Irish Tax Hub team.

Irish tax returns at fair prices, with one-to-one service from Damien and the Irish Tax Hub team.

Pricing

Choose the plan that best fits your needs. All plans include a thorough review of your tax situation. Any questions? Contact us.

Covers most taxpayers

More suitable for complex tax situations

Not sure which plan is right for you?

Compare all featuresWatch Damien explain our Standard and Comprehensive Tax Return Packages.

Learn which one is right for you.

Getting your Irish tax return filed is simple and secure. Click on each step to learn more.

Select Plan & Pay Securely

Complete quick online form

We process your Irish tax return

Receive direct rebate

Note: The process above is for our Standard Tax Return plans. For the Comprehensive plans, we will schedule a 30 minute call to get everything ready for your return.

Your privacy and security are our top priority. All sensitive information is handled securely and can be deleted once your return is processed if requested. Refunds are paid to you directly by Revenue, ensuring a safe and trustworthy process.

Damien and the Irish Tax Hub team carefully review every return, ensuring meticulous attention to detail and maximizing your potential refund.

"I'm passionate about restoring trust in the tax return industry through a fair pricing model, high quality of service and free to use tax tools. I am committed to ensuring that you receive all the tax credits and reliefs that you are entitled to.

Damien Roche

LinkedIn ProfileTax Advisory Expert

Ex Deloitte Tax Manager

Tax and Accounting Dual Qualified

Every case reviewed individually

Up-to-date with tax legislation

CPA, ACA and CTA qualified with over 6 years of experience

All tax returns submitted within 5 business days

Need something else?

Plans designed to suit your needs

Perfect for anyone who sold assets during the year.

Learn MoreSuitable if you received a gift or inheritance during the year.

Learn MoreIncrease your salary after tax and reduce your taxes payable.

Learn MorePredictable costs:

Know exactly what you'll pay upfront, regardless of your refund amount.

Keep more money:

With refunds often in the thousands, our flat fee leads to substantial savings compared to commission-based services.

Fair for everyone:

Whether your refund is €1,000 or €3,000, you pay the same fair price for our expert service.

FAQs

Here are some of our most frequently asked questions about Irish tax returns. If you have a question that's not answered here, please email us at info@irishtaxhub.ie

Many people who leave Ireland during a tax year are entitled to claim a refund of taxes on their tax return due to Split-Year Treatment. Click here to learn more.

We will review your position and submit your tax returns within 5 days of receiving your information.

Unlike other tax return service providers, we do not charge commission. We apply a flat fee of €49 for straightforward tax returns and €299 for complex tax returns. The 'No refund no fee' policy results in a much higher average fee due to the fact that a 'service fee' is being charged based on the refund amount. We believe that this commission based model should not be applied to tax return services.

Documents may be required depending on your specific situation. Select and purchase a plan here, and we will email a form to complete the tax information gathering process. We will reach out to you via email for any other documents that are required.

Yes, you can claim tax relief on most medical expenses at the standard rate of 20%. This includes doctor visits, prescribed medicines, and certain dental treatments.

Tax refunds are limited to the past four tax years; therefore, it's vital to submit your tax return as soon as possible.

When starting a new job, your employer might initially lack the necessary information to apply your full tax credits, leading to temporary emergency tax deductions. Learn more about emergency tax here.

You will receive your refund directly to your bank account from Revenue.

First select and pay for one of our four year plans here. You will then receive and email with a link to a form to complete an online application, which allows us to review your taxes. Next, we'll check your tax information on Revenue's online system and submit your tax return within 5 working days. Revenue will then issue your refund directly to your bank account once they have accepted our submission (usually within 2 weeks).

This depends on your specific circumstances. We recommend that you authorize Irish Tax Hub to do a full review of your position by choosing one of our tax return plans so that we can determine your entitlement to any credits/reliefs. Some examples of expenditure which you can claim tax back on are;

If we notice that you've selected the wrong plan, we'll get in touch with you.

You can file your Irish tax return online quickly and accurately through Irish Tax Hub’s Tax Return Services. We handle all the paperwork, calculations, and submissions to Revenue, ensuring your return is compliant and filed on time. Our service covers Form 11, Form 12, PAYE refunds, and self-assessment returns.

For self-assessment taxpayers in Ireland, the online filing and payment deadline for the 2024 tax year is typically in mid-November 2025 (exact date set by Revenue each year). Filing before the deadline avoids late penalties and interest charges.

Form 11 is used by self-employed individuals, company directors, and those with non-PAYE income. Form 12 is for PAYE workers who have additional income or want to claim tax reliefs. Irish Tax Hub can advise which form applies to you and complete it on your behalf.

Yes. PAYE workers can file a tax return to claim overpaid tax, medical expense relief, rent tax credit, or other credits. Irish Tax Hub can check your eligibility and process your refund claim.

The easiest way is to use Irish Tax Hub’s expert Form 11 filing service. We gather your details, prepare your return, and submit it through Revenue Online Service (ROS), ensuring accuracy and maximising your tax efficiency.

Reporting rental or foreign income can be complex. Irish Tax Hub will prepare and file your return, ensuring all income is declared correctly and that you claim any available deductions or double taxation reliefs.

Non-residents and expats can file through Revenue Online Service (ROS) or by appointing Irish Tax Hub to file on their behalf. We specialise in handling returns for individuals living abroad but earning Irish-source income.

Once Revenue processes your return, they will issue a Statement of Liability or Notice of Assessment, usually within a few weeks. Refunds are typically issued soon after approval. Irish Tax Hub monitors your return status and follows up with Revenue as needed.

Late filing can result in a surcharge of up to 10% of your tax due, plus daily interest. Using Irish Tax Hub helps you file on time and avoid costly penalties.

You can claim a refund for the previous four tax years. For example, in 2025 you can claim back to 2021. Irish Tax Hub can review past years to maximise your refund.

When we prepare your return at Irish Tax Hub, we include the rent tax credit if you meet Revenue’s eligibility criteria. You’ll just need to provide proof of rent paid.

You can claim tax relief on qualifying medical expenses not covered by insurance. Irish Tax Hub will ensure all eligible expenses are included to reduce your tax bill or increase your refund.

Refund amounts vary, but many clients receive €800 - €1,500 depending on circumstances and reliefs claimed. Irish Tax Hub can calculate your likely refund before filing.

Common claims include rent tax credit, medical expense relief, home carer credit, and pension contributions. Irish Tax Hub will identify and apply all credits you qualify for.

You can log in to myAccount to complete Form 12, but using Irish Tax Hub ensures your return is complete, accurate, and optimised for refunds - saving you time and hassle.

Not always - but if you want to claim reliefs or refunds, you must submit a return. Irish Tax Hub can check your entitlement and file for you if it’s beneficial.

If you spot an error, you can submit an amended return through ROS or myAccount. Irish Tax Hub can handle the amendment process to ensure Revenue receives the correct details.

Yes, but you must declare worldwide income if you’re Irish-resident. Irish Tax Hub can file your return and ensure you benefit from any double taxation reliefs.

Typical documents include payslips, receipts for expenses, rental statements, and foreign income records. Irish Tax Hub will provide you with a full checklist before we begin.

You can register with Revenue for self-assessment online - but Irish Tax Hub can register you, guide you through the process, and prepare your first return, ensuring full compliance from the start.

We're proud to be affiliated with these prestigious organizations.